TShum/iStock via Getty Images

About a year ago, I wrote an article covering the growing specialty coffee market. In this article, I will zero in on the fast-growing retail segment and the two leading players — Starbucks Corporation (NASDAQ:SBUX) and Luckin Coffee (OTCPK:LKNCY).

Overview

Coffee consumption—the headlines

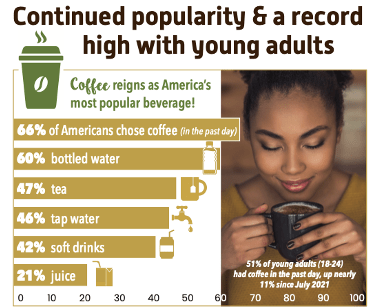

We see headlines and press releases declaring that coffee consumption has hit high a two-decade high, “Coffee is more popular than any other beverage including tap water”, “66{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of Americans now drink coffee each day, … up by nearly 14{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} since January 2021” (Figure 1), Americans drank an estimated 491 million cups of coffee every day (or almost 2 cups per adult), and consumption is increasing even as coffee drinkers grow cautious about their spending habits.

Figure 1 Coffee is more popular than tap water

National Coffee Association USA

We also read US National Institute of Health reports citing evidence that coffee consumption is inversely associated with cognitive decline in certain elderly demographic groups, which could potentially boost demand amongst the older generation.

Behind the headlines – a tale of two cities

Interestingly, the numbers tell different story: statistics from the International Coffee Organization indicated world coffee consumption grew at a rate of just 1.0{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} per annum rate from 2017-2021 and a mere 3.3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} from 2020 to 2021, while Mordor Intelligence projects an optimistic growth rate of 4.7{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} p.a. from 2022-27.

These statistics obscure an underlying tale of two cities: demand for lower quality and instant coffee has been falling, but this has been offset by strong demand for high-end specialty coffee and experiential coffee.

(1) Reduced demand for lower quality and instant coffee:

A wave of strong growth in coffee consumption took place after World War II with the introduction of instant coffee, which made coffee easy to prepare and easily accessible for home consumption. However, as I wrote in my previous article:

According to Jerry Baldwin, co-founder and former chief roaster of Starbucks (NASDAQ:SBUX), major roasters like Maxwell House focused on marketing over coffee quality, and kept costs down by gradually increasing the proportion of the cheaper and less palatable Robusta beans in favor of higher quality Arabica beans. Even though the change was reportedly imperceptible to existing drinkers, the instant coffee became unpalatable to most new drinkers and per-capita consumption started to decline in the 1960s. US coffee consumption of instant coffee fell from 75 percent of American adults drinking three cups a day in 1962 to less than 50 percent of American adults drinking under than two cups a day several decades later.

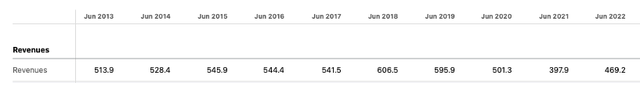

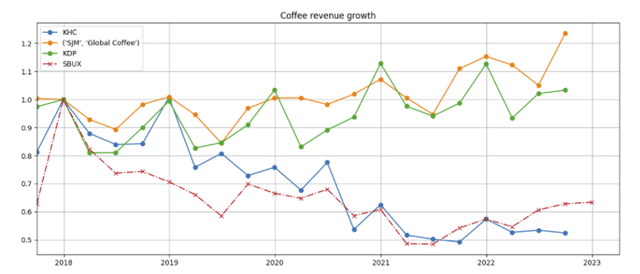

Sales of lower quality coffee, such as what is sold in your local gas station, convenience store, or local diner, has been down (Farmers Bros. (FARM), saw its sales sputter (Figure 2), though some of its problems were self-inflicted, which I will not go into). Similarly, there has been a 50{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} decline in coffee sales at Kraft Heinz (KHC), which owns the Maxwell House brand (Figure 3, blue line) and Folgers (owned by J. M. Smucker (SJM), orange line). Revenue growth of Keurig Dr. Peppers’ coffee segment, which is driven by its K-cup franchise, is still positive but appears to be decelerating (green line).

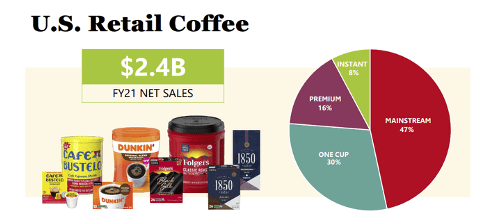

Kraft Heinz tried but failed to sell Maxwell House in 2019. I posit the increase in Smucker’s coffee sales was driven by its higher quality brands (Medaglia D’Oro, Pilon, and Bustelo Espresso products and Dunkin coffee) (Figure 4), and its partnership with Keurig Dr Pepper’s (KDP) K-Cup systems.

Figure 2 Revenue of Farmer Bros

Seeking Alpha

Figure 3 Revenue of consumer-packaged coffee sales

Author using publicly available information

Figure 4 Smuckers coffee brands

Company presentation

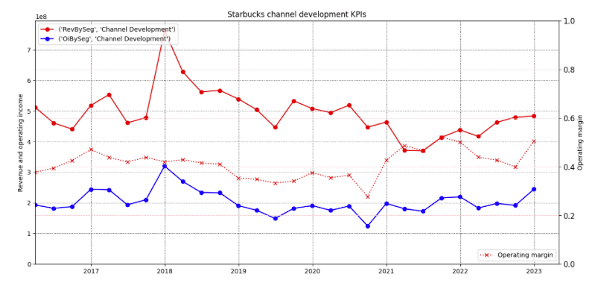

I note that the decline in Starbucks’ consumer packaged coffee revenue (Figure 3, solid red line, left axis) is a result of its 2017 decision to transition from a direct sales model under its previous partnership with Kraft (which no doubt contributed to the decline in Kraft’s coffee sales) to a licensing model under the Global Coffee Alliance partnership with Nestle Foods (OTCPK:NSRGY), for which Starbucks receives and books royalty income instead of total sales, which results in higher margins (Figure 5, dotted red line, right axis). As Nestle has a far wider global distribution network than Kraft Foods, I expect revenues in Starbucks’ consumer-packaged segment to grow over the long term.

Figure 5 Starbucks consumer product segment financials

Author using publicly available information

(2) Strong and growing demand for high-end specialty coffee and experiential coffee:

Alfred Peet, who founded Peet’s Coffee and Tea (now owned by JDE Peet’s (OTCPK:JDEPF)) in 1966, emphasized artisanal sourcing, roasting, and blending of coffee made from more expensive arabica beans. He is often credited with starting the movement away from lower-quality instant coffee towards high-quality specialty coffee, which industry observers have nicknamed the “second wave of coffee”. (Interestingly, I was told by a coffee “expert” in Vietnam that many coffee drinkers in his country prefer their coffee made with the cheaper robusta beans mixed with burnt corn, but this is most likely the exception rather than the rule).

In his book Pour your heart into it: how Starbucks built a company one cup at a time, Starbucks founder and CEO Howard Schultz describes how his own experience in Italy’s espresso bars inspired him to emphasize the experiential aspects of coffee drinking in Starbucks stores, particularly the barista-customer connection as well as the way the beverage is delivered to and consumed by customers. Today, many consumers consider coffee a daily affordable luxury and total experience, and they routinely meet socially and professionally over a cup of high quality coffee in conveniently located stores furnished with comfortable chairs, tables, and sofas, which prompted Starbucks to nickname itself the “third place” (after consumers’ homes and workplaces).

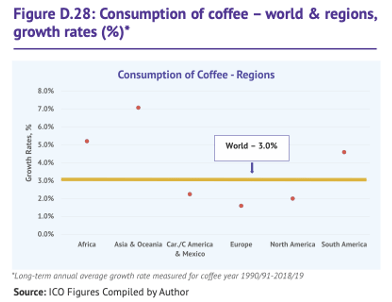

This demand for high-end, experiential coffee has made its way from the western world into Asia and China—traditionally tea drinking regions–are experiencing particularly strong consumption growth (Figure 6).

Figure 6 Growth in coffee consumption (link)

International Coffee Organization

These trends have driven solid growth for global coffee retail store operators such as Starbucks, Costa Coffee (owned by Coca-Cola (KO)), Peets (owned by JDE Peet’s), as well as Luckin Coffee—a China-focused operator.

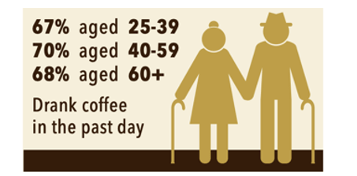

Attractive consumer demographics

According to the National Coffee Association of the United States, coffee consumption in the US is well distributed across the different age groups (Figure 7). More importantly, it notes rising and record high popularity with young adults in the 18-24 age range—which bodes well for the longer term prospects of the industry.

Figure 7 Coffee consumption cross different age groups

National Coffee Association USA

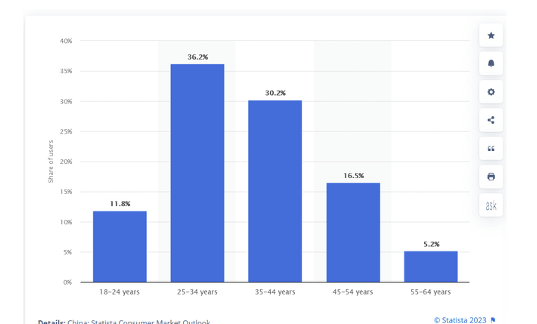

In China, data from Statista indicates on the ages of coffee consumers are heavily skewed towards younger adults (Figure 8), and anecdotal evidence from my own observations of the clientele in both Starbucks and Luckin stores corroborate the data.

Figure 8 Age distribution of coffee consumers in China in 2021

Statista

Source: Statista, from Seeking Alpha article Starbucks Saw Ways To Fuel Growth

Investment thesis for Starbucks and Luckin

Both companies are leaders with well-regarded brands in an oligopolistic industry where scale matters, and are well-positioned to benefit from the strong growth in demand for high quality, experiential coffee.

Starbucks and Luckin are the largest and most visible players in their core markets, which are the US, China, Japan, South Korea, Canada, and the United Kingdom for Starbucks; China for Luckin.

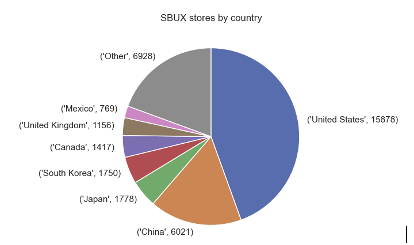

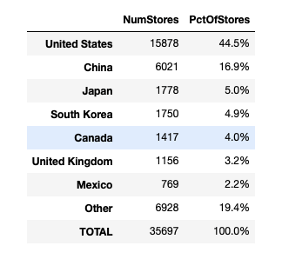

Interestingly, even though Starbucks has stores in over 80 countries, 80{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of Starbucks stores are located in seven countries (Figure 9), of which only three (the US, China, and Japan) have more than 5{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of the company’s total stores. The company operates its own stores in just eight countries, and wisely partners with local licensees in most of the other countries.

Figure 9 Starbucks store distribution for top 7 countries

Author using publicly available information

A comparison of the store count of major coffee players back up my observations about Starbucks and Luckin’s market leadership (Figure 10):

Figure 10 Major coffee chain store counts (both company operated and licensed)

|

Starbucks (4Q2022) |

Luckin (3Q2022) |

Costa Coffee(1) (end-2021) |

JDE Peet’s (end-2021) |

|

|

US |

15,878 |

0 |

||

|

China |

6,021 |

7,846 |

70 |

|

|

International |

3,798 |

0 |

Most in the UK |

|

|

Total |

35,697 |

7,846 |

Over 4000 (2,3) |

505 (4) |

- Costa appears to be rolling out a line of BaristaBot machines reminiscent of its parent Coca-Cola’s soda fountain and vending machine strategy

- Store locator (excludes 10,000 Smart Café machines)

- Item 2 from Coca-Cola 2021 Form 10-K filing states it has 1,587 leased locations

- JDE Peet’s 2021 annual report

Scale matters as the large players have more bargaining power against landlords and suppliers as well as more stores to spread their marketing, research & development, and technology platform investments. In addition, coffee retail stores are also desirable — there have been multiple reports that home values rise when a Starbucks location enters the neighborhood.

In the US, Starbucks competes against the coffee businesses of fast-food chains such as Dunkin (privately held), McDonald’s (MCD), and Restaurant Brands’ (QSR) Tim Hortons and Burger King, but none of these are dedicated to coffee and do not provide the same quality “third place” experience. In addition, it also competes against many smaller chains and mom & pop operations, but none have the same scale and resources as Starbucks.

Competition between Starbucks and Luckin in the China market is not as fierce as it appears, and both companies will benefit from the country’s lifting of its zero-COVID policy.

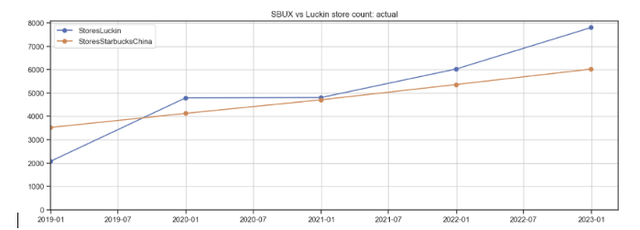

The media portrays Starbucks and Luckin as direct rivals locked in an intense race to capture the Chinese coffee market by opening the most stores, and that Luckin is leading the race with 7,800 stores compared to Starbucks’ 6,021 stores (Figure 11, blue line vs orange line).

Figure 11 Starbucks vs Luckin: store count

Author using publicly available information

However, their strategies and target segments are not identical: Starbucks targets the upper end of the premium, luxury coffee market (typically workers in Class A offices, high end malls, and residential buildings) and has built large, welcoming, and comfortable “third place” meeting places for the younger demographic – many of whom may be living in cramped apartments or with their parents (Figure 12).

Figure 12 Starbucks store in China (Shanghai)

Company

In contrast, Luckin is aiming for the “mass-premium” market with decent coffee at lower price points than Starbucks in A-minus office buildings, commercial areas, and university campuses. The majority of stores are smaller (200 to 600 square feet) with limited seating (Figure 13) that are optimized for quick store pickup and deliveries. Luckin’s delivery orders represented 21.8{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a}, 20.6{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} and 27.4{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of total orders in 2019, 2020 and 2021, respectively.

Luckin also operates a small handful of larger stores of over 1,200 square feet (which it calls “relax stores”) for branding purposes. These stores compete directly with Starbucks but they accounted for under 3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of Luckin stores at the end of 2021. Luckin entered the “unmanned retail” market and operated 1,100 unmanned Luckin Coffee Express vending machines. However, the initiative has not gone as well as expected, and company has made the decision to scale back the concept.

Figure 13 A typical Luckin store

Company

While Starbucks remains focused on coffees and teas, Luckin has taken a little more of a Dutch Brothers approach by combining its coffees and teas with milk, fruits, and tapioca pearls to create novel drinks such as prune flavored velvet lattes, and it has introduced over 100 SKUs since the beginning of 2022.

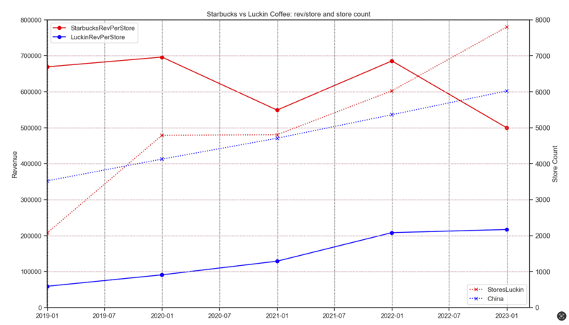

As Starbucks targets a higher-end coffee market, its per store revenue is more than twice that of Luckin’s (Figure 20below, solid lines, left axis). However, Starbucks relies more on customer in-store visits, so China’s zero-COVID policy and strictly enforced lockdowns has impacted it far more than Luckin, which is well-suited for pickup and delivery orders. As a result, Starbucks’ per store revenue trended down over the last two years even as Luckin’s same store sales continued to climb (as will be discussed below).

Both companies will benefit from the Chinese government’s December 2022 lifting of the country’s zero-COVID policy, but I expect Starbucks to enjoy a stronger rebound as consumers begin returning to its stores.

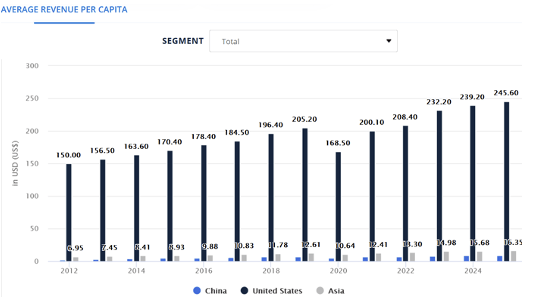

The China and Asian markets are still far less penetrated than the US

In 2022, the revenue per capita spent on roasted coffee in Asia and China is just 6{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} and 3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} that of the US. However, the revenue per capita in Asia has nearly doubled over the last 10 years from less than $7 to just under $13.30 (Figure 14).

Even though it is unrealistic to expect the per capital spending in Asia and China to catch up with the US, it is reasonable to expect it to continue rising for the foreseeable future.

Figure 14 Revenue per capita spent on coffee in China and Asia vs the US

Statista

Source: Statista, from Seeking Alpha article Starbucks Saw Ways To Fuel Growth

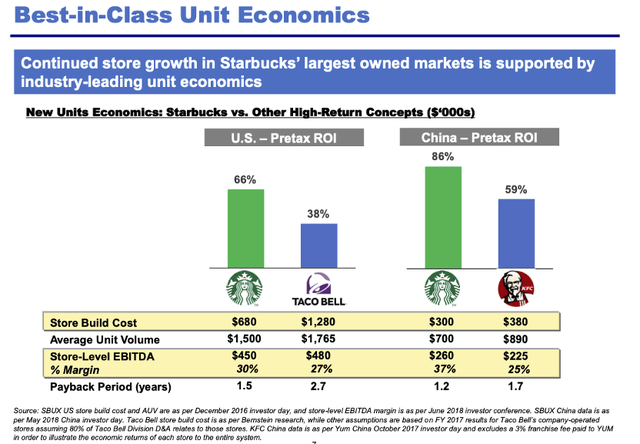

Highly attractive unit economics

According to a 2018 presentation by Pershing Square Capital Management (Figure 15), new store units in the U.S. generate ~30{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} cash EBITDA margins and 66{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} pretax ROIC, for a 1.5-year payback. New units in China performing even better, generating 37{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} cash EBITDA margins and 86{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} pretax ROIC, for an astonishing 1.2-year payback.

Figure 15 Unit economic analysis from Pershing Square Capital Management (2018)

Pershing Square Capital Management

Quality, away from home coffee is relatively price inelastic

This is particularly true at the premium end of the market where consumers view their high-quality coffee as both an affordable luxury and necessity. Some have developed a routine of jump-starting their day by picking up a cup of coffee from the store on the way to work and are unlikely to cut back their consumption over relatively small price increases (although these small price increases do add up over time).

As Starbucks delivers consistent quality around the world, its lattes cost as much in Beijing and Delhi Beijing as they do in the average American city and are often significantly much more expensive than coffee at the local mom and pop stores. However, travelers who visit an unfamiliar city are more likely purchase their daily coffee from a familiar chain rather than risk walking out of a local store with undrinkable coffee. (For those who still question the price inelasticity, how often have you walked out of a Starbucks empty handed to an unfamiliar nearby mom and pop store just because the price was moderately higher than what you were used to at home?)

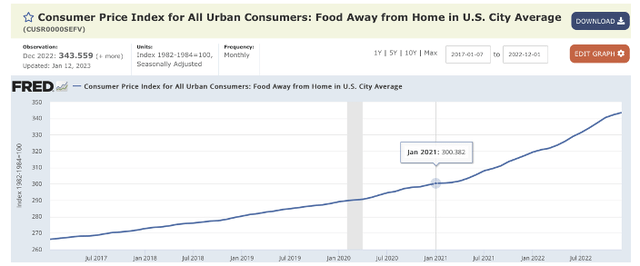

A study by the Federal Reserve Bank of Cleveland found that prices of food away from home is among the most “sticky” components of the consumer price index, i.e., the prices change infrequently and are less volatile. In addition, the consumer price index of food away from home in the average US city has shown a consistent upward trajectory over the past 5 years and increased by 14.4 percent over the past 2 years (Figure 16).

Figure 16 Consumer price index for food away from home

FRED, St. Louis Federal Reserve

Both companies have demonstrated good execution but are not without issues

Starbucks’ smart use of technology, which a Financial Times article attributed to former CEO Kevin Johnson’s technology background, was instrumental in enabling Starbucks to enhance the customer experience, outpace other retailers in mobile ordering and payments, and lay the IT groundwork that enabled it to adapt quickly to COVID-19 pandemic with faster turnaround of mobile orders and open more drive-through stores at optimal locations.

However, the company also faces some uncertainty with the abrupt retirement of Kevin Johnson without a named successor as well as unionization drives in a number of its stores, which I will discuss in the concerns section below.

Luckin has rolled out an impressive number of new stores across China at a rapid pace through both company-owned stores as well as partnerships in second and third tier cities. It now operates 7,800 stores, compared to Starbucks’ 6,021 stores.

In 2020, Luckin was hit with serious accounting fraud in which its CEO Jenny Zhiya Qian and Chief Operating Officer Jian Lu were found to have fabricated 2.2 billion yuan (or USD310 million) of transactions and overstated expenses by USD190 million in an attempt to conceal the fraud. The company fired both individuals, ousted four board members (including Chairman Charles Lu) and paid a USD180 million penalty to settle the charges. The shares were delisted from the NASDAQ exchange in June 2020 but have continued to trade over the counter.

Analysis of store count and revenues by product category and geography

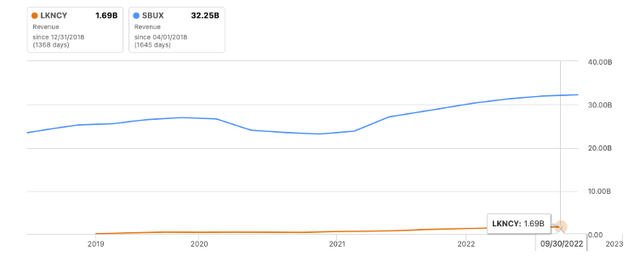

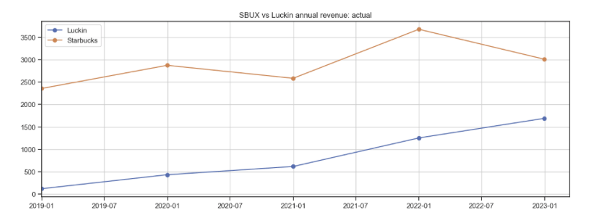

Globally, Starbucks’ most recent trailing twelve-month (TTM) revenue is twenty times that of Luckin (Figure 17).

Figure 17 Revenue comparison

Seeking Alpha

Revenue by product category

Over the last five years, 60{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of sales at Starbucks are from beverages, 20{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} from food, 20{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} from “other” (primarily packaged and single-serve coffees and teas, ready to drink beverages, and serveware). Excluding revenues from partnership stores, Luckin’s revenues from freshly brewed drinks has been trending up from 80{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} in 2019 to almost 90{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} in 2021.

Stores and revenue by geography

The US and China are Starbucks’ most important markets: of its almost 36,000 stores, 45{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} are in the US, and 17{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} are in China (Figure 18). Even though the company operates in over 80 markets globally, half of its international stores outside of China are concentrated in five countries—Japan, South Korea, Canada, the United Kingdom, and Mexico.

Figure 18 Countries with most Starbucks stores

Author using publicly available information

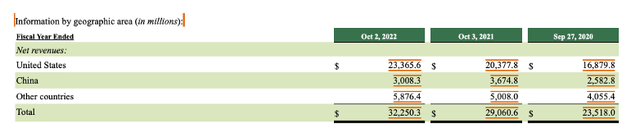

Starbucks derives about 72.5{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of its revenue from its North American stores, 9.3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} from China, and 18.3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of revenue from its non-China international stores (Figure 19). 74{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of the company’s international (ex-China) revenue (or about 13.5{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of total revenue) is generated in Japan, Canada, and the U.K. (South Korea and Mexico generate less revenue but have higher margins as they operate through licensed stores).

Figure 19 Starbucks revenue by segment

Starbucks 2022 10-K filing

Over 95{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of Starbucks’ consolidated revenues are derived from five countries (the U.S., China, Japan, Canada, and the U.K.). In contrast, all Luckin’s stores are within China, from which it generates substantially all its revenue and operating income.

Comparison of key operating metrics by region

China

China is Luckin’s only market and Starbucks’ second largest market, but founder Howard Schultz reiterated in September 2022 his belief that China will overtake the U.S. as Starbucks’ largest market as soon as 2025.

As of Q3 2022, Luckin has more stores in China than Starbucks (7,800 vs 6,021) (Figure 20, dotted lines, right axis). However, Starbucks has twice the revenue in China compared to Luckin (Figure 21) and about two and a half times the revenue per store (Figure 20, solid lines, left axis) as its premium store locations and “third home” store format enabled it to command higher price points.

Figure 20 Starbucks and Luckin: Store count and per store revenue

Author using publicly available information

Figure 21 Starbucks vs Luckin China revenues

Author using publicly available information

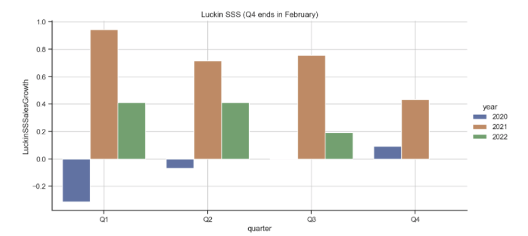

After the initial drop following the COVID-19 outbreak in early 2020, Luckin’s same store sales growth has stayed positive (Figure 22) through China’s strictly enforced zero-COVID policy and lockdowns, largely due to its emphasis on in-store pick-up and delivery orders.

Figure 22 Luckin same store sales

Author using publicly available information

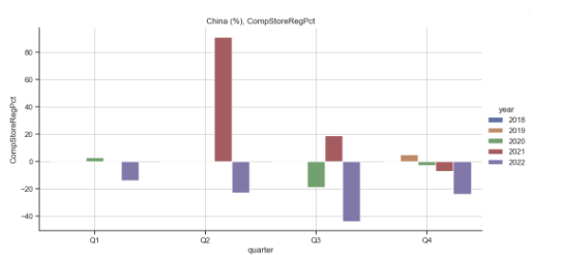

Starbucks’ same store sales, on the other hand, has suffered as the number of transactions and ticket sizes shrank in 2021 and 2022 because the country’s zero-COVID caused up to 900 of its stores to be shut, many stores were unable to operate at full capacity, and customers were restricted from gathering in its stores.

Figure 23 Starbucks China same store sales growth

Author using publicly available information

Even though China lifted most of its COVID restrictions in December 2022, traffic and subway ridership in major cities remain well below the longer-term average as people continue to voluntarily practice social distancing as a matter of habit and stay indoors–possibly due to the New Year spring festival. However, I believe it is a matter of time before the country returns to its pre-pandemic normal and crowds start flocking back to Starbucks’ stores.

Starbucks is likely to experience a sharper rebound compared to Luckin as the economy re-opens, and a Goldman Sachs analyst listed Starbucks among the stocks poised to best benefit from China’s re-opening.

The U.S.

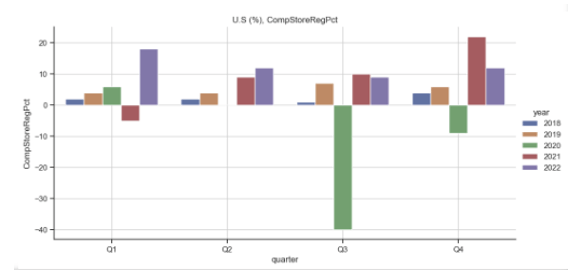

The US, which is by far Starbucks’ largest market, has recovered from the COVID-19 pandemic. Comp store sales, which dropped sharply following the outbreak in 2020 (Figure 24, green bars), rebounded strongly in 2021 and 2022 (pink and red bars).

Figure 24 Starbucks US same store sales

Author using publicly available information

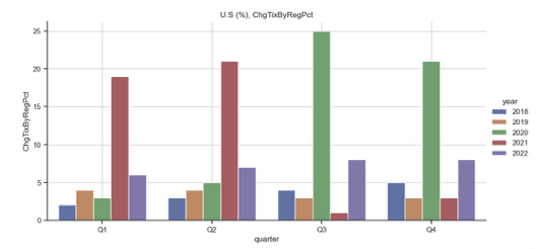

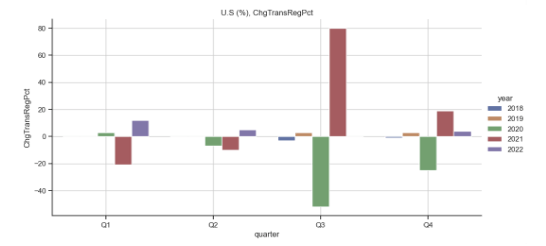

In late 2020 and early 2021, same store sales was driven a strong rise in ticket size (Figure 25) even as the number of transactions rebounded less sharply (Figure 26) because consumers made fewer trips to the stores but bought more during each visit. The trend reversed itself in Q3 2021 as the COVID risk subsided and consumers began returning to the stores. However, ticket sizes rose again in 2022 as commodity and labor cost inflation ticked up, which Starbucks was able to pass onto consumers through price increases.

On the Q4 2022 earnings call, Starbucks CEO Howard Schultz noted that it was able to raise prices 6{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a}, indicating that the real, inflation-adjusted ticket size growth for the quarter was closer to 2{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a}. He further noted that even though he did not see loyalty or transactions abate, he would not further raise prices for the time being (as a quick note, this is comment supports the price inelasticity argument in my thesis).

If inflation subsides in response to the Federal Reserve’s aggressive interest rate hikes as expected, the increase in nominal ticket size will likely recede, but this will hopefully be offset by the longer-term growth in transaction count when the Fed is able to loosen its monetary policy when inflation gets under control.

Figure 25 Starbucks US change in ticket size

Author using publicly available information

Figure 26 Starbucks US change in transaction count

Author using publicly available information

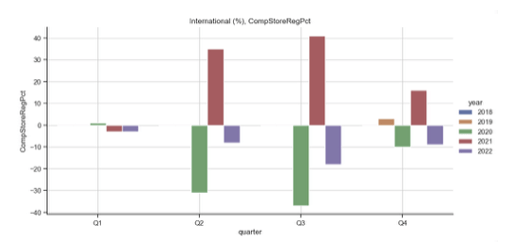

International markets (excluding China)

Starbucks’ non-China international revenue is about 18.3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of overall consolidated revenue. Of this, 74{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a}, or about 13.5{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of the company’s revenue, is generated in Japan, Canada, and the U.K. (South Korea and Mexico generate less but more profitable revenue as they operate through licensed partnership stores).

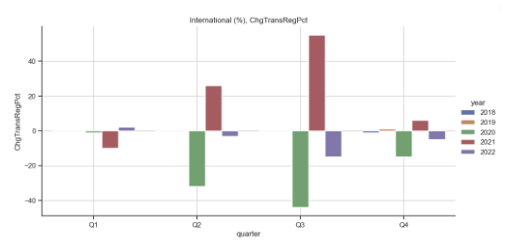

Since the COVID-19 outbreak in 2020, Starbucks’ international ex-China comp store sales growth has been weak (Figure 27) as transactions dropped sharply but recovered slowly (Figure 28) because consumers remained cautious and governments controlled borders more tightly, particularly in Japan, which did not lift tourist restrictions until the fourth quarter of 2022.

Figure 27 Starbucks international (ex-China) comp store sales

Author using publicly available information

Figure 28 Starbucks international (ex-China) change in transactions

Author using publicly available information

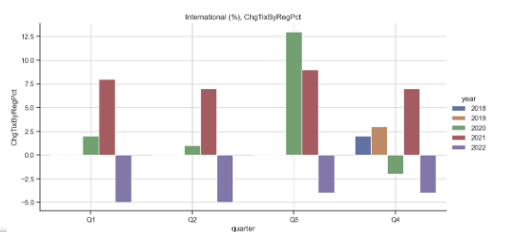

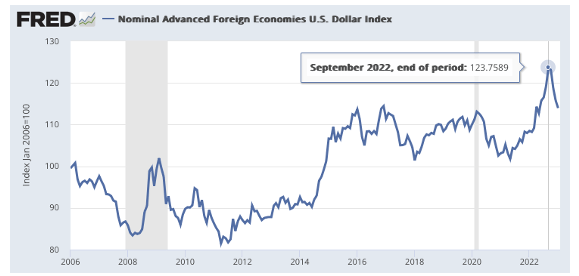

The average ticket size, which is measured in US dollars (Figure 29), was further impacted by the strong US dollar, which strengthened to a 15-year high against the currencies of other advanced foreign economies (Figure 30).

Figure 29 Starbucks international (ex-China) change in ticket size

Author using publicly available information

Figure 30 The nominal advanced foreign economies US Dollar index

FRED, St. Louis Federal Reserve

Most major economies around the world have finally opened, which will drive transaction count. I expect comp store sales to strengthen with the transaction count as well as ticket size growth when the value of the US Dollar regresses to its longer-term levels.

Upside from additional store openings

China

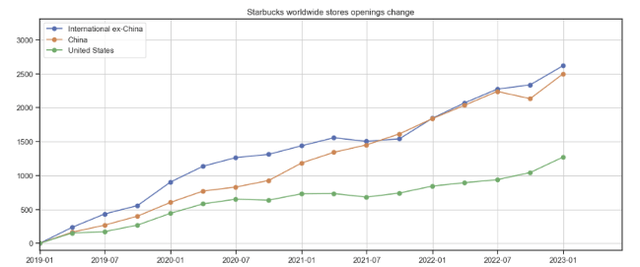

Since January 2019, Luckin has almost quadrupled its store count, from about 2,000 to 7,810 (Figure 21, right axis), and management noted on the Q3 2022 earnings call that it plans to “[m]aintain a strong and competitive expanding pace of store openings to further increase our presence and better meet consumer needs”. Over the same period, Starbucks increased its store count by 2,500 (from around 3,500 to over 6,000), and founder and interim CEO Howard Schultz has repeatedly remarked that China will overtake the U.S. as Starbucks’ largest market as soon as 2025.

I assume that both companies have taken advantage of the depressed retail real estate market and lower rents resulting from stores going out of business due to the COVID-19 lockdowns to secure attractive locations for their new stores.

The U.S. and international markets

Since January 2019, Starbucks has opened about 1,300 new US locations in the US. It also opened 2,620 new international locations outside of China—twice the number in the US and more than new locations in China (Figure 31). The countries with the largest number of new stores outside of China and the US include South Korea, Japan, Saudi Arabia, India, the UK, Indonesia, Turkey, France, Malaysia, and the UAE.

As Starbucks only owns and operates stores in eight countries (US, China, Japan, Canada, United Kingdom, Switzerland, Austria, and Italy), a large number of stores around the world are operated by local partners through licensed partnerships – these are likely more capital efficient as the local partner foots at least part of the store capital expenditures, as well as to generate more stable revenue and higher margins if Starbucks receives licensing payments. Starbucks management has stated its intent to continue opening more stores around the world.

Figure 31 Starbucks new store locations

Author using publicly available information

Main Concerns

Starbucks

(1) CEO succession

Two previous CEOs have not worked out and had to be rescued by founder Howard Schultz.

Jim Donald, who served as CEO from 2005-2008, was held responsible for expanding the chain too quickly and was replaced by Howard Schultz. Kevin Johnson, who took over as CEO from Schultz in 2017, resigned unexpectedly without a successor in 2022, and Schultz again returned as interim CEO. As senior management separation agreements typically come with non-disparagements clauses, the average investor may never find out the circumstances behind his departure.

CEO-designate Laxman Narasimhan, who was previously CEO of Reckitt Benckiser Group, a British hygiene, health, and nutrition products, is expected to take over the helm from Schultz on April 1, 2023. Mr. Narasimhan has extensive experience in consumer products and strategy but does not appear to have direct experience running far flung retail store operations or managing labor union relationships.

In mitigation, Starbucks is a high-profile well-respected firm, and its search team likely had a choice of world class candidates. I expect the company to have done its job and due diligence to ascertain that Mr. Narasimhan is the best person for the role, even if the company’s track record for CEO succession has been spotty at best.

(2) High turnover at senior management level

In addition to former CEO Kevin Johnson, there are press reports that a number of executives either departed or were removed from their positions, including:

- Jen Quotson, vice president of creative studios at Starbucks, who announced her departure after 14 years at the firm;

- Tim Scharrer, the head of Starbucks’s coffee-trading arm, who left in the fall;

- Rossann Williams, head of North America;

- Rachel Gonzalez, General Counsel;

- John Culver, Chief Operating Officer;

- George Dowdie, a long-serving executive vice president of global supply chain; and

- Javier Teruel, a long-serving board member, resigned.

While the company appears to be executing well, I always worry about high executive turnover, which could be the canary in a coal mine.

(3) Unionization drive

Starbucks has resisted an initial wave of unionization efforts, with former CEO Kevin Johnson stating that “the formation of a union at some of the company’s cafes could disrupt the chain’s relationship with its workers” and “could make the firm less agile in responding to its workforce”. To date, just 3{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} of its US stores, or about 269 stores, have been unionized, but the push is apparently fading.

As I lack the expertise and insight on labor relations to opine further, I suggest that those with an interest should refer to the firm’s public filings and other resources.

(4) Starbucks could be asked to exit China, akin to what happened to Uber

The Wall Street Journal’s August 2016 article titled, “Uber’s China exit, another US tech innovator bows to Beijing’s nationalism” summarizes the concern well. While not mentioned in the WSJ article, I conjecture that like Google, Uber was instructed to cease its operations because the Chinese government was concerned about the information Uber was gathering about its citizens and their movement patterns.

In mitigation, even though Starbucks gathers information on customer purchase habits, it lacks the same level of detailed information as Uber or Google. In addition, there were reports in January 2021 by both the Associated Press and Chinese news agency XinHua about a cordial exchange between Chinese President Xi and Starbucks founder Howard Schultz, in which President Xi asked the Mr. Schultz “to continue to play a positive role in advancing China-U.S. economic and trade cooperation and bilateral ties”. I may be reading too much into it, but this suggests that Starbucks is viewed favorably by the Chinese government leadership at this time.

(5) Coca-Cola capturing a share of the coffee market with Costa Coffee’s BaristaBot

Since Coca-Cola acquired Costa Coffee in 2019, it has developed the BaristaBot, which I liken to its soda fountain machines that can dispense customized, high quality espresso drinks using fresh Costa beans and fresh milk (Figure 32). If successful, these BaristaBots could raise the standard of coffee in restaurants across the US and around the world, expand the market, potentially capturing share from Starbucks and Luckin.

I note that Luckin had limited success executing a similar strategy with its operator-less vending machines, but I would not under-estimate the power of Coca-Cola’s execution and distribution reach.

Figure 32 Costa Coffee BaristaBot

Company

(6) Over-saturation of stores?

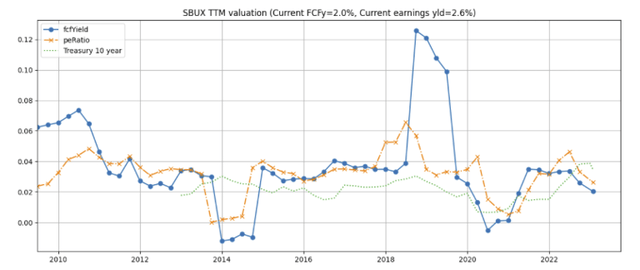

A quick search of Apple maps shows seventeen Starbucks stores in a nine by four block section of Midtown Manhattan (Figure 33). My anecdotal observations and US same store sales numbers (Figure 24) indicate that the stores continue to do brisk business, but this is something to watch closely.

Figure 33 Starbucks stores in Midtown Manhattan

Apple Maps

Luckin Coffee:

(1) History of accounting fraud

In 2020, the Securities and Exchange Commission charged Luckin with “defrauding investors by materially misstating the company’s revenue, expenses, and net operating loss in an effort to falsely appear to achieve rapid growth and increased profitability and to meet the company’s earnings estimates.” Luckin subsequently agreed to pay a $180 million penalty to settle the charges and was delisted by the Nasdaq as a result of the fraud. The company stated that it is working to get the stock relisted but it still trades on the less-liquid OTC Market at this time.

Interestingly, downloads of the Luckin app—the main platform to place orders—surged and hit a record after the news, suggesting that consumers were not fazed by the fraud, which was reminiscent of the 1963 American Express salad oil scandal where a young Warren Buffett quietly amassed a 5{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} stake in the company after observing that incident did not affect cardholders’ willingness to use their credit cards.

(2) Organizational structure

Luckin’s structure involves the use of a Beijing WFOE (wholly foreign owned entity) and VIEs (variable interest entity) that is discussed in detail in Luckin’s 2021 Form 20-F filing with the Securities and Exchange Commission. The structure has not been tested in court, and I admit that I do not have my arms around exactly how the structure really works or China’s regulation of such entities. However, I note that Charlie Munger, Chairman of the Daily Journal Corporation and a trained lawyer, was sufficiently comfortable with the structure of Alibaba (BABA), which is similar to Luckin’s, to take up a sizable position for the Daily Journal in 2021 (although he was reported to have cut the position in half).

(3) China ADR delisting risk

In 2021, Chinese companies traded on New York exchanges faced the risk of delisting as the US Securities Exchange Commission finalized the rules implementing the Holding Foreign Companies Accountable Act requiring companies based in both China and the US give the US Public Company Accounting Oversight Board inspectors the ability to audit specific documents to establish whether they are owned or controlled by a foreign government. However, the risk is subsiding as Beijing has shown a willingness to make concessions.

Valuation

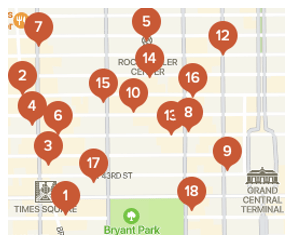

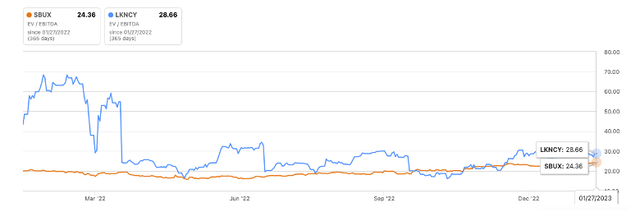

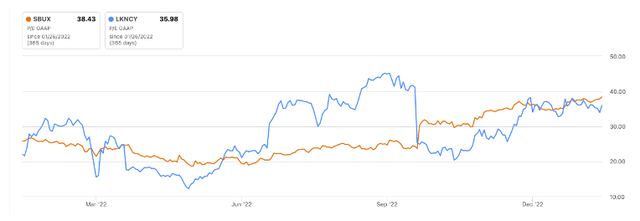

Starbucks and Luckin are not undervalued as both trade at enterprise value to EBITDA multiples of well over 20x (Figure 34) and price-earnings ratios of over 30x (Figure 35). Starbucks’ free cash flow yield of ~2{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} reinforces my observation (Figure 36).

If one expects both companies to grow with the opening of new stores, the shares may represent “growth at an attractive price” for longer term investors.

Figure 34 Enterprise value to EBITDA multiple

Seeking Alpha

Figure 35 Price earnings ratio

Seeking Alpha

Figure 36 Starbucks free cash flow yield

Author using publicly available information and stock price data

Share count

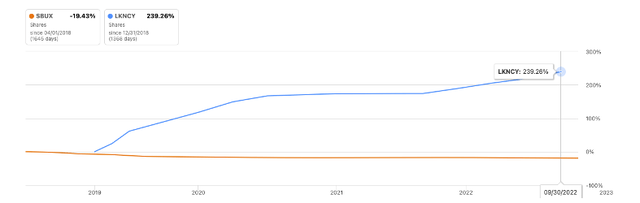

While Luckin has increased its shares by almost 240{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a}, Starbucks has reduced its shares outstanding by almost 20{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a} since 2018 and is paying shareholders a dividend that is yielding around ~2{ead4cb8c77dfcbdb67aba0af1ff8dfae0017fcc07a16fe7b51058939ac12c72a}. Starbucks actions indicate management and its board’s confidence in both the growth and stability of the company.

Figure 37 Share count comparison

Seeking Alpha

In summary

Starbucks and Luckin are leaders with well-regarded brands in an oligopolistic industry where scale matters, and are well-positioned to benefit from the strong growth in demand for high quality experiential coffee.

Key drivers and metrics to watch are new store openings and same store sales growth. Both companies have likely taken advantage of the weak retail environment through the COVID-19 pandemic to open stores at attractive lease rates.

As China has lifted COVID-19 restrictions and employers around the world summon employees back to the office, same store sales for Luckin and Starbucks coffee will get a near-term boost from the resulting increase in demand.

Valuations are not cheap, but both companies’ shares could offer long-term investors good growth at attractive prices.

For aggressive investors, Luckin may be a good play on the recovery and growth in China but comes with considerable country, regulatory, and company-specific risks.

Even as Starbucks works through its CEO transition and unionization issues, I prefer its global diversification, premium positioning, and more steady profile, and intend to add to my position upon a pullback.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.